I met one of my college friends a couple of days back. Our meeting lasted about 45 minutes. We covered almost all the hot topics.. Rahul G’s leave management, IT layoffs, PK success, Physics (his favorite subject since college days), Financial Planning (my favorite subject)….

(My friend has done graduation in Chemical Engineering & works for a Software company. Physics has been his all time favorite subject)

He has been following my blog for quite sometime now. So, when I started discussing about Money management, he immediately asked for an Acronym, so that he can relate both Financial Planning and Physics to it. He wanted to link the important aspects of Financial Planning to it.

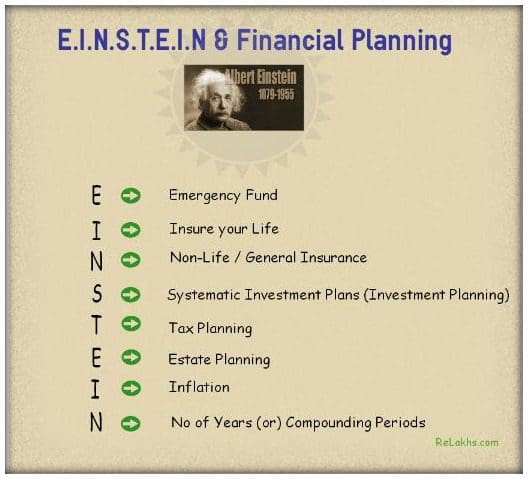

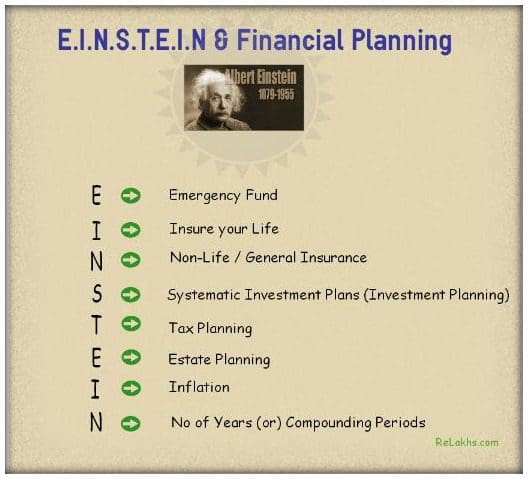

Physics…Financial Plan…Acronym…hmmm…I immediately got below idea and shared this with him.

When he said Physics, I immediately remembered Albert Einstein – inarguably one of the most brilliant men who’s ever lived.

E.I.N.S.T.E.I.N & Financial Planning aspects…. Let’s relate them..

E : Emergency Fund – Create and maintain an Emergency (or) Contingency Fund. You can accumulate a fund which is around 3 to 6 times of your monthly expenses. Everyone has wants, needs and desires when it comes to spending money. Make sure you have atleast three months’ worth of emergency income available for the ‘NEEDS’. You can save this fund in Short-term Fixed deposits or Keep it in Sweep-in Accounts or just keep cash in hand (a portion of the fund). Avoid letting unexpected expenses or events lead you to financial ruin. Build your emergency fund.

I : Insure your Life – This should be your second step in creating simple and effective Financial Plan. You should have sufficient Life Insurance Coverage. It is not ‘how much premium’ you pay, but it is ‘how much Life insurance coverage’ (Sum Assured) you have which is more important. So, do you need to pay high premium to get sufficient coverage? Yes, if you opt for money-back or Endowment policy. No, If you opt for a good and affordable Term insurance Plan. (I may be repeating this nth time on my blog..hmm..sorry.. but there are lot of people who still believe that “Buying Term insurance plan is a waste of money.”)

N : Non-Life Insurance Coverage – The third step is to identify your non-life insurance (General Insurance) requirements. These can be your motor / vehicle insurance, personal accident coverage, mortgage insurance, home insurance, mediclaim etc.,

S : Systematic Investment Plans – The fourth aspect of financial plan is to save and invest in Systematic Investment Plans periodically. These investments can be done in various avenues like Mutual Funds, Fixed Deposits, Equity, Bonds etc., But, before selecting the financial products, it is prudent to first identify and set realistic Financial Goals. As per your goal requirements, you have to choose various investment products with different risk profiles, to achieve your goals. These goals can be, Your Retirement Plan and accumulation goals like Kid’s Education goal (or) Kid’s marriage goal (or) Vacation planning etc., (Read my article on “How to create a Solid Investment Plan?“)

T : Tax Planning – While creating your investment plan, try to identify and invest in tax-efficient products. But, kindly note that Tax saving should not be the sole criteria for choosing the investments.

E : Estate Planning – This is also known as ‘wealth distribution or transfer.’ Let us assume that you have created a good protection plan and good wealth accumulation strategies. But, what is the use of building assets and buying insurance policies if you have not mentioned proper nominations on your investments. Estate Planning is the process of making a plan in advance and naming whom you want to receive the things you own after you die. Write you Will.

I : Inflation – Creating a Financial Plan is dependent on few assumptions. One of the most important assumptions that we have to make to create a good Financial Plan is ‘Inflation.’ In simple terms, it can be defined as either a rise in prices or a fall in the value of money. You need to be aware of prevailing ‘inflation’ rates. The Retirement corpus, Kids education goal etc., are totally dependent on the assumption of certain rate of Inflation. You have to review and modify your Financial plan (if required) based on the prevailing inflation trends in the Economy. (Sometimes we may see deflation too)

N : No of Years / Compounding Periods – To make an effective Financial Plan, it is of utmost importance to understand the importance of Time Value of Money. Components of Time value of Money formulas are investment amount (payment), Future Value / Present Value, Rate of Interest and No of Years (N). Out of all the components, N is damn important. The earlier you start investing, the more you can benefit from compounding. Also, align your investment planning according to the time-frame of your goals. For example, if you are planning for your Retirement which is 20 years from now, you should not be conservative and should not invest in Fixed Deposits alone. If you do so, inflation will eat away all your savings/investments. You need to take risk depending on the investment time-frame of your goals.

“Compound Interest” is the most powerful force in the universe (or) man’s greatest invention. Compound interest is the eighth wonder of the world – Albert Einstein

(Though these quotes are mentioned in many books / blogs, there is no evidence that he ever said such a thing. Whether he said this quote or not, it does not change the fact that ‘compound interest’ should be on the mind of anyone looking to build wealth over time)

When my friend started speaking about his favorite subject “Physics”, I immediately mentioned the above Einstein’s quotation….:)

If you are a ‘Do It Yourself’ investor, implement the above steps to create a simple and effective financial plan. Next time when you think of E.I.N.S.T.E.I.N, think about Financial Planning too and vice versa

for further details and more information : http://www.relakhs.com/